The Punjab government launched the Karobar Card Loan Scheme to assist startups and small enterprises. To assist business owners in expanding their operations, generating employment, and boosting the economy, it provides interest-free loans. Young people with low incomes find the loans, which have repayment terms of seven years and vary from PKR 100,000 to PKR 15 lakhs, to be an alluring choice.

Quick Facts

| Feature | Details |

|---|---|

| Loan Amount | PKR 100,000 to PKR 15 lakhs |

| Interest Rate | 0% (Interest-Free) |

| Repayment Period | Up to 7 Years |

| Target Audience | Small & Medium Businesses |

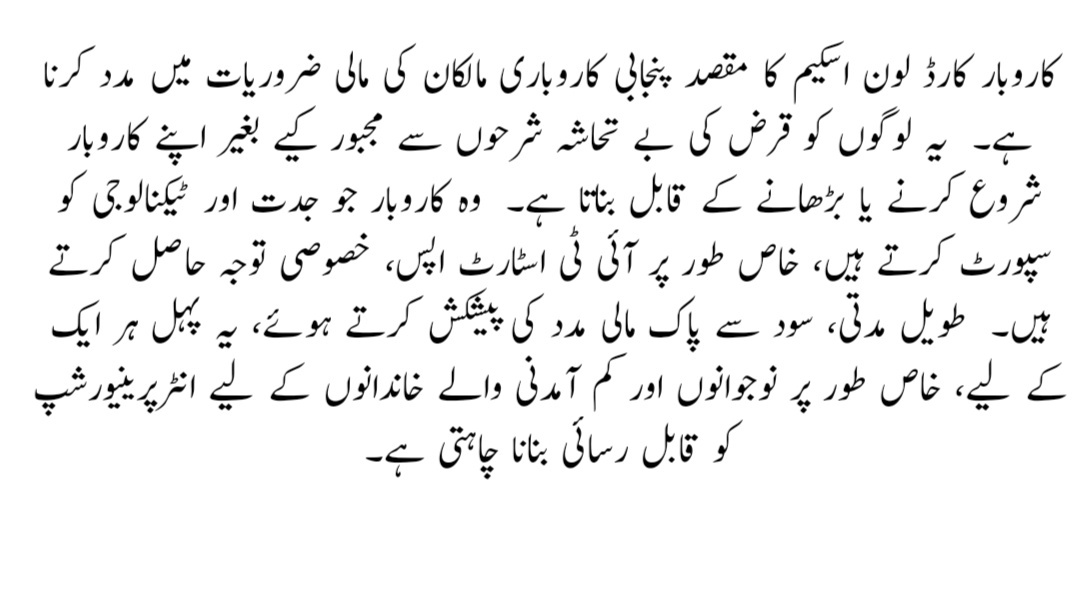

What is the Karobar Card Loan Scheme?

The Karobar Card Loan Scheme is intended to help Punjabi business owners with their financial needs. It enables people to launch or grow their enterprises without being constrained by exorbitant loan rates. Businesses that support innovation and technology, especially IT startups, receive special attention. By offering long-term, interest-free financial support, the initiative seeks to make entrepreneurship accessible to everyone, particularly young people and low-income families.

Eligibility Criteria

To qualify for this scheme, applicants must meet certain requirements:

- Age: Between 18 to 55 years.

- Residency: Permanent resident of Punjab.

- Business Type: IT startups and innovative ventures are prioritized.

- Income Level: Low-income families are encouraged to apply.

- Business Plan: Applicants must present a clear plan showing loan usage.

Meeting these criteria ensures that only deserving individuals benefit from this opportunity, encouraging sustainable entrepreneurship across Punjab.

How to Apply

Applying for the Karobar Card Loan Scheme is simple:

- Online Portal: Registration is done online via the official platform.

- Fill the Form: Provide personal and business details.

- Submit Documents: Upload your CNIC, proof of residence, and a detailed business plan.

- Verification: Applications are reviewed, and shortlisted candidates are contacted.

Ensure that all the information is accurate to avoid delays during the selection process.

Benefits of the Scheme

This program offers numerous advantages for aspiring entrepreneurs:

- No Interest: Loans are completely interest-free.

- Flexible Repayment: Repayment can be spread over 7 years.

- Focus on Innovation: IT startups and creative ideas receive special attention.

- Economic Impact: Creates job opportunities and reduces unemployment.

These features make the scheme ideal for those looking to start or grow their businesses without financial stress.

Required Documents

Applicants need to prepare the following:

- Valid CNIC

- Proof of residence (utility bill or rent agreement)

- Detailed business plan

- Recent passport-sized photographs

- Six months’ bank statement

Additional documents may include guarantor details or proof of business registration, depending on the application.

Conclusion

For people in Punjab, the Karobar Card Loan Scheme offers a game-changing chance to start or grow their enterprises. Offering interest-free loans with adjustable payback terms, the initiative promotes innovation and empowers business owners, especially in the IT industry. In addition to helping individuals, this program fortifies the province’s economic base.

Also

FAQs

What is the maximum loan amount?

The maximum amount is PKR 15 lakhs.

Can non-residents of Punjab apply?

No, only permanent residents of Punjab are eligible.

Is there any priority sector?

Yes, IT startups and innovative businesses are given preference.

What happens if I miss a repayment installment?

Contact the concerned department immediately to discuss possible solutions.